Are you an avid tech enthusiast who's been longing to get their hands on the latest iPad, but the hefty price tag has been holding you back? Well, we've got some good news for you! Today, on May 15th, 2023, you can buy the latest iPad in the UK and pay for it later. That's right; you read it correctly! With the 'buy now pay later' option, you can own the latest iPad without burning a hole in your pocket. So, let's dive right in and explore this fantastic deal that you wouldn't want to miss out on!

Buy now pay later iPad UK

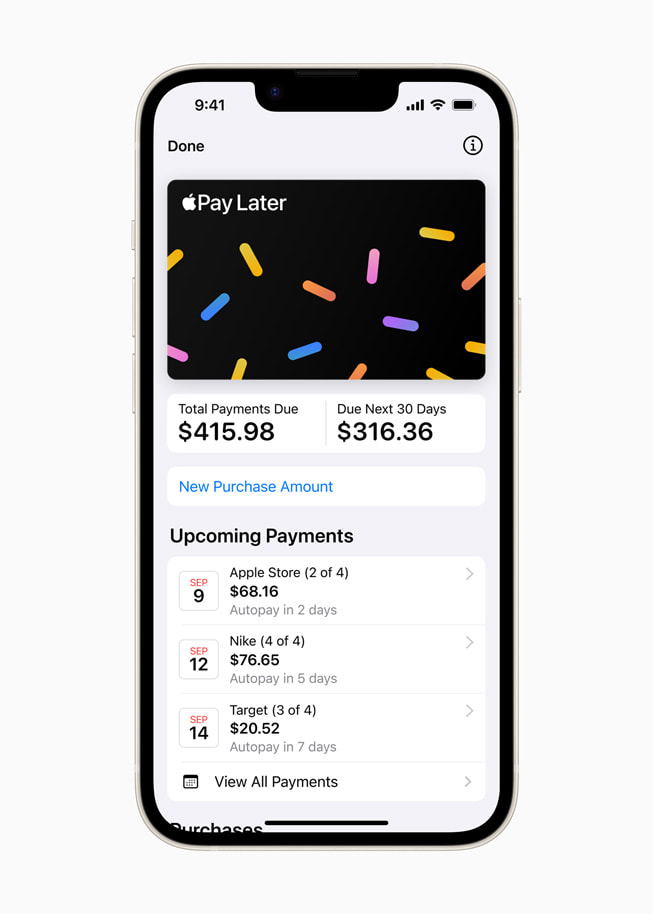

In the UK, customers can now purchase an iPad using the buy now, pay later option through various merchants. Affirm, a popular payment platform, offers customers a chance to purchase their dream iPad with flexible payment options. One can pay over time at 0% APR with no late fees and no hidden charges. With Affirm Pay in 4 payment option, customers can pay in four easy installments without incurring any extra costs. To avail of this service, customers can request a virtual card in the Affirm app, which can be used for online or in-store purchases. Affirm has partnered with various lending institutions, and interest rates range from 0-36% depending on creditworthiness. Customers can choose their payment options based on their purchase amount and merchant policies. Through this service, customers can enjoy the benefits of quick and easy financing while owning the latest iPad in the market. [1][2]

1. iPad Deals and Offers

May2023 is the perfect time to hunt for an iPad deal in the UK. The leading retailers offer discounts on various Apple models, from the lightweight iPad Mini to the powerhouse iPad Pro. Savvy shoppers can make use of the discounts and save on the high price tag that usually accompanies Apple's products. Buyers should consider purchasing a refurbished iPad from retailers such as Amazon, MusicMagpie, or third-party resellers. The refurbished products offered by these companies come with a warranty and go through an extensive refurbishing process, ensuring that they are in tip-top shape. For those who do not need the latest and greatest model, sticking with an older iPad may be worth considering, especially if the price difference is significant. Shoppers should research the specs and read reviews to determine the best model for their needs. Finally, buyers can follow tech blogs to stay up to date with current deals and offers. [3][4]

2. Financing with Interest-Free Pay Monthly Plans

Financing with interest-free pay monthly plans has become increasingly popular among consumers in recent years. This type of financing, also known as buy now pay later (BNPL), allows shoppers to make purchases and pay for them in installments without accruing interest. The ease of approval and fixed payment schedule make BNPL a convenient option for those who may not have access to traditional forms of credit. However, it’s important to consider any potential risks, such as late payment fees and the impact on credit scores for missed payments. Despite these risks, the popularity of BNPL continues to rise, with major retailers partnering with BNPL providers to offer their customers these payment options. It’s up to consumers to weigh the benefits and risks of BNPL and decide if it’s the right choice for their financial situation. As with any financial decision, it’s important to research and consider all options before making a purchase. [5][6]

3. Advantages of Owning an Apple iPad with O2

Oning an Apple iPad with O2 comes with a multitude of advantages. The iPad offers the balance of a laptop’s power and performance with the convenience and design of a tablet. Whether using it to make a movie or create music, iPad has all the tools to get the job done. An intuitive interface, interactive texts, front and back cameras, and impressive educational apps and content, the iPad is perfect for transforming how teachers teach and students learn. For business purposes, iPad serves as a personal assistant, presentation expert, scanner, and accountant. With its thin and lightweight design, iPad is perfect for users to become more productive in more places. The new iPadOS 16 with App Library, multitasking features, external keyboard options, widgets, and improved note-taking has made working with an iPad even more productive. The latest A15 Bionic-chip-powered iPad Air also offers all-day battery life and is incredibly portable, making it perfect for taking on the go. With versatile options, the iPad is perfect for anyone looking to work or play. [7][8]

4. Creative Tools and Features

When comes to creative tools and features, the iPad has a lot to offer. With features like the Apple Pencil and the Procreate app, artists and designers have the ability to create stunning artworks with ease. The Apple Pencil allows users to write and draw with precision, while the Procreate app provides a wide range of brushes, colors, and effects to choose from. For those interested in photography and video, the iPad also offers editing tools in the form of apps like iMovie and Adobe Lightroom. These apps provide a range of features such as the ability to crop, adjust lighting and apply filters to your photos and videos. Additionally, the iPad's multitasking feature makes it easy to work on multiple projects at once, even allowing users to use split-screen mode for added convenience. With these tools, the iPad is an excellent option for creative professionals and hobbyists alike. [9][10]

5. How iPad is Transforming Education

The iPad has revolutionized education by providing a versatile tool for students and teachers alike. With the iPad, students can access educational apps, digital textbooks, and online resources. Teachers can create interactive lessons and presentations, grade assignments, and communicate with students. The iPad’s portability allows for learning to happen anywhere, anytime. Additionally, the iPad’s features such as split-screen multitasking and digital note-taking have improved productivity and organization for students and educators. The accessibility features on the iPad also cater to students with special needs. In combination with traditional teaching methods, the iPad has proven to increase engagement, motivation, and student achievement. The use of iPads in education has been a growing trend globally with schools and universities adopting Apple’s technology. Technology has enhanced learning, and the iPad has become a staple of modern education. [11][12]

iPad financing UK

Q: Can I finance an iPad in the UK?

A: Yes, there are various financing options available in the UK for purchasing an iPad. You can consider financing through Apple, which offers interest-free financing for up to 12 months. You can also use a credit card that offers instalment plans, or use buy now pay later services like Klarna or PayPal Credit.

Q: What is the eligibility criteria for iPad financing?

A: The eligibility criteria for iPad financing varies depending on the financing option you choose. Typically, you must be over 18 years old, have a valid UK address, and meet the credit score requirements of the financing provider.

Q: Can I finance any model of iPad?

A: Yes, most financing options offer financing for all iPad models available in the UK.

Q: What are the interest rates for financing an iPad?

A: The interest rates for financing an iPad vary depending on the financing provider and the terms of the financing agreement. Interest rates may range from 0% to upwards of 30%.

Q: Is there a minimum or maximum amount that can be financed for an iPad?

A: The minimum and maximum amount that can be financed for an iPad may vary depending on the financing provider. Typically, the minimum amount may be around £99, and the maximum amount may be up to £2,000 or more.

Remember to carefully read the terms and conditions of any financing agreement before making a decision. [13][14]

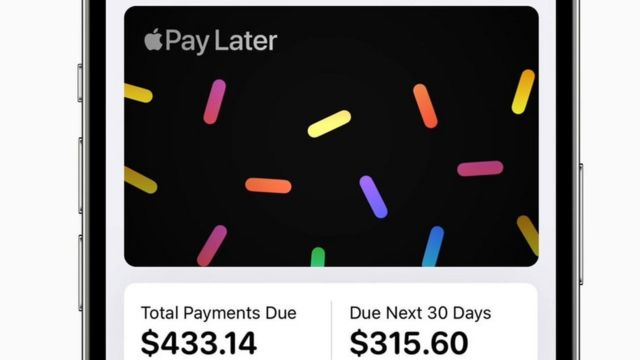

Apple Pay Monthly UK

What is Apple Pay Monthly in the UK?

Apple Pay Monthly is a subscription service offered by Apple in the UK that allows customers to purchase Apple products, such as iPhones and iPads, and pay for them in monthly installments.

How does it work?

Customers can choose to pay for their chosen product over a period of 12, 24, or 36 months. There are no upfront costs, and the monthly payments are interest-free. Customers can also choose to upgrade to the latest model of the product after a certain period, usually 12 months, by returning the original one.

What products are available?

Apple Pay Monthly is available for a range of Apple products, including iPhones, iPads, and Macs.

What are the eligibility requirements?

To be eligible for Apple Pay Monthly, a customer must be 18 years or older and have a UK bank account. The customer must also pass a credit check.

Are there any additional fees?

There are no additional fees for using the Apple Pay Monthly service. However, if a customer misses payments, there may be late payment fees and interest charges. [15][16]

Klarna iPad UK

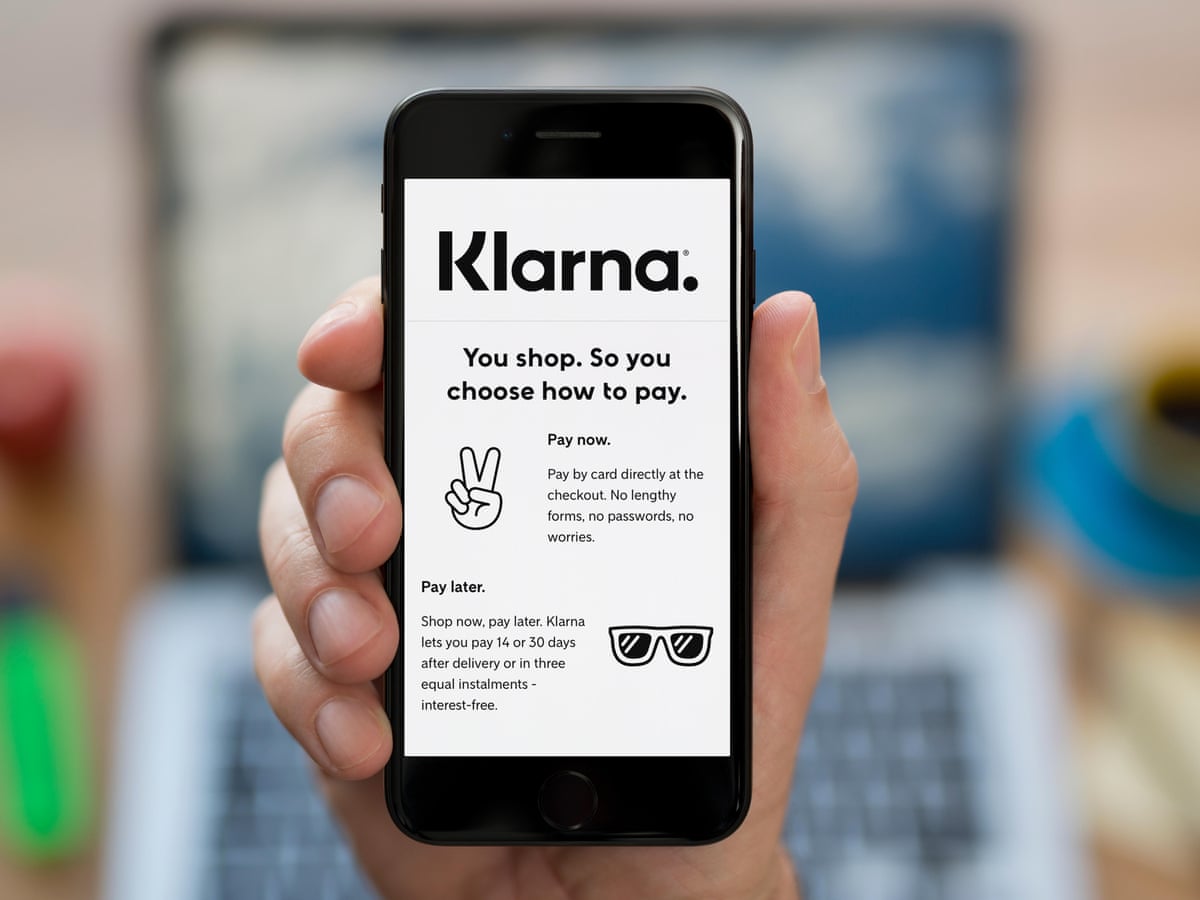

What is Klarna iPad UK?

Klarna is a service that allows you to buy an iPad in the UK and pay for it later. The service is available through participating retailers and allows users to make purchases using different payment options such as Pay in 30 days or Pay in 3 installments.

Is Klarna safe for iPad purchases?

Klarna is a reputable service with strong anti-fraud controls in place to protect customers from unauthorized purchases. However, users should be aware of the potential risks of using buy now pay later services, including the potential impact on their credit score if they fail to make payments on time.

How does Klarna work for iPad purchases?

Users can choose to pay for iPad purchases using Klarna at checkout. They can then select their preferred payment option, such as Pay in 30 days or Pay in 3 installments. Users will receive reminders about their payments and can manage their orders and payments through the Klarna app.

Does Klarna affect credit score for iPad purchases?

Klarna has begun sharing information with credit agencies about customers' purchases in the UK. While this does not currently impact credit scores, it may do so in the future. Users should ensure they make payments on time to avoid any negative impact on their credit score.

What happens if I don't pay for my iPad purchase with Klarna?

If users fail to make payments on time, they will be in default and may be unable to use the service in the future. There may also be added interest and fees. It is important to pay attention to payment reminders and manage payments through the Klarna app to ensure timely payments. [17][18]

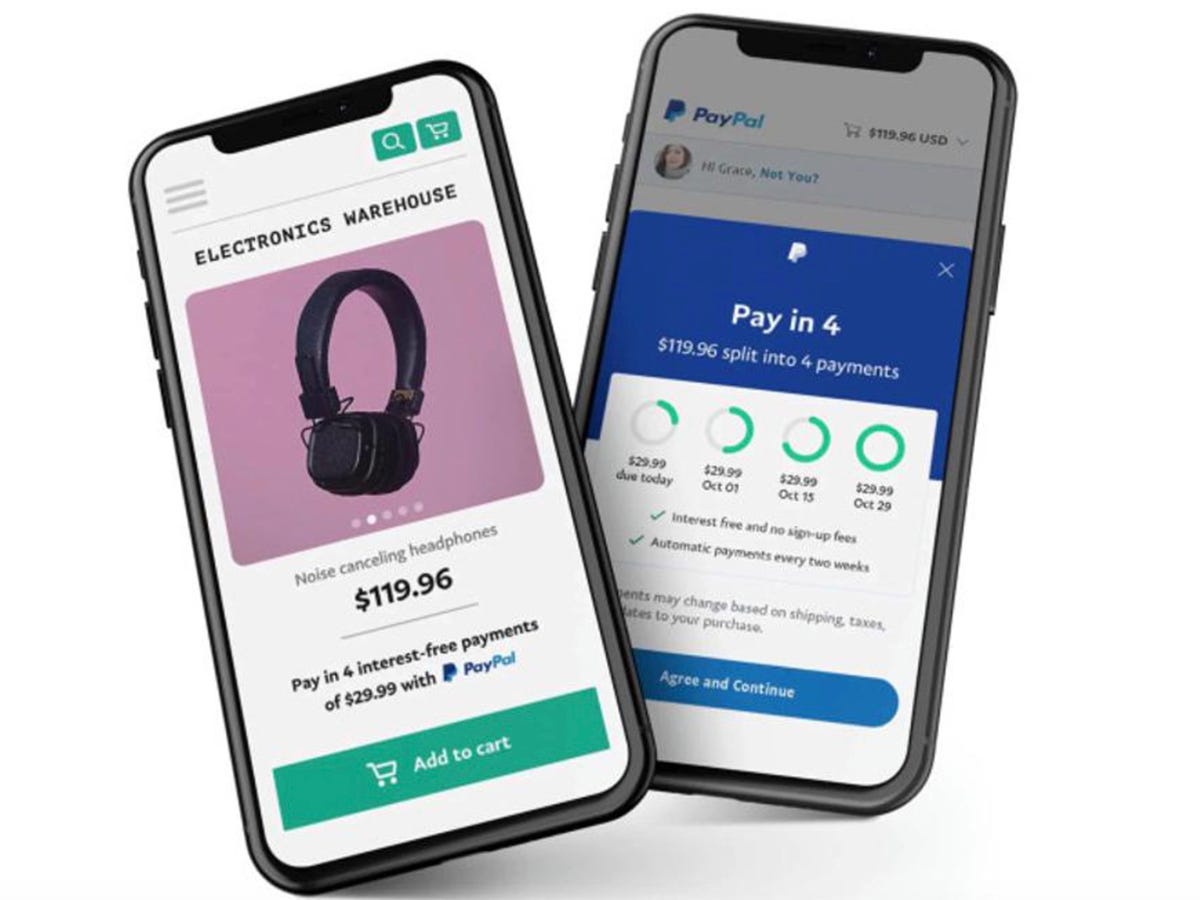

PayPal Credit iPad UK

FAQ on PayPal Credit for iPad in the UK

What is PayPal Credit?

PayPal Credit is a credit line that you can apply for within your PayPal account and use as a funding method for online purchases. It offers 0% interest on selected transactions, monthly instalments options at selected online stores and instalment plans over 6 to 24 months with lower interest rates.

How can I apply for PayPal Credit on my iPad?

To apply for PayPal Credit, you need to have a PayPal account. You can sign up for a PayPal account via the PayPal website or the PayPal app on your iPad. Once you have a PayPal account, simply log in and apply for PayPal Credit.

How much interest will I be charged?

If you take advantage of PayPal Credit's offers and promotions, including the 0% for 4 months offer, the interest rate that applies will be lower in many circumstances. Transactions under £99.00 will be charged interest at a rate of 21.9% p.a. (variable).

What is the credit limit for PayPal Credit?

Your credit limit for PayPal Credit will be determined based on your credit status.

Is PayPal Credit available for business accounts?

Yes, PayPal Credit is available for business accounts.

Are there any late fees for PayPal Credit?

There are no late fees for PayPal Credit on 0% offers. However, to maintain the 0% offer, you need to keep up with monthly repayments and stay within your credit limit.

Is PayPal Credit regulated?

PayPal Credit is deemed authorized and regulated by the Financial Conduct Authority and is a trading name of PayPal (Europe) S.à r.l. et Cie S.C.A. Société en Commandite par Actions Registered Office: 22-24 Boulevard Royal L-2449 Luxembourg RCS Luxembourg B 118 349.

Can I use PayPal Credit to buy an iPad?

Yes, you can use PayPal Credit as a funding method to buy an iPad at selected online stores. [19][20]

Clearpay iPad UK

What is Clearpay, and can I use it to buy an iPad in the UK?

Clearpay is a form of credit that allows you to pay for purchases over four interest-free instalments, due every two weeks. If you're a permanent UK resident (excluding the Channel Islands) and at least 18 years old, you may be eligible to use Clearpay. However, late fees of up to £24 per purchase may apply, and missed payments could negatively impact your ability to use the service in the future.

So, can you use Clearpay to buy an iPad in the UK? The answer is yes, but it depends on the retailer. Some UK retailers, such as M&S and Foot Locker, allow you to use Clearpay to buy an iPad. To use Clearpay, you need to download their app and check if your preferred retailer is a Clearpay partner. Once you've selected your iPad and added it to your basket, follow the instructions to pay with Clearpay at checkout. It's important to ensure you can make repayments on time, as Clearpay is not regulated by the Financial Conduct Authority. [21][22]

Affirm iPad UK

What is Affirm and how does it work with iPad purchases in the UK?

Affirm is a financing solution that allows customers to buy now and pay later for products, including iPads. When purchasing an iPad in the UK, customers can select Affirm as their payment option at checkout. Affirm offers flexible payment plans tailored to each customer's individual needs and creditworthiness. This includes options to pay over 3 to 24 months with interest rates based on creditworthiness and eligibility. There are no hidden fees and customers can see the exact terms and total amount of interest before making a purchase.

Is the Affirm iPad financing option available in stores in the UK?

Currently, Affirm's financing option for iPad purchases is only available online in the UK. Customers can select Affirm as their payment option while checking out on the retailer's website.

How do I know if I am eligible for Affirm financing?

To determine eligibility for Affirm financing, customers must complete a soft credit check. This means that Affirm will review the customer's credit report without impacting their credit score. Based on the credit check, Affirm will determine the customer's eligibility and offer customized payment plan options. [23][24]

Zip iPad UK

What is Zip iPad UK?

Zip iPad UK is a financing option that allows customers to purchase an iPad in the UK and pay for it in installments, rather than paying the full price upfront.

How does Zip iPad UK work?

Customers can apply for financing through Zip, which will perform a credit check and determine whether or not they are eligible for the financing option. If approved, customers can choose to pay for their iPad over a period of 6, 12, or 24 months, with interest rates varying depending on the length of the payment plan.

What iPad models are available for Zip iPad UK?

Customers can choose from a variety of iPad models, including the iPad Air, iPad Pro, and iPad Mini.

Are there any additional fees with Zip iPad UK?

Customers will be charged interest on their financing plan, which varies depending on the length of the payment plan chosen. There are no additional fees for using Zip iPad UK.

How do I apply for Zip iPad UK?

Customers can apply for Zip iPad UK financing through the Zip website. They will need to provide personal and financial information, and Zip will perform a credit check to determine eligibility. If approved, customers can choose their iPad and payment plan and will receive their device once the first payment is made. [25][26]

Laybuy iPad UK

What Laybuy iPad UK?

Laybuy iPad UK is a buy now pay later (BNPL) service that allows users to pay for their iPad in installments without paying any interest or fees. It is a service provided by Laybuy, one of the main operators of BNPL services in the UK. With Laybuy iPad UK, users can buy the latest iPad and spread the cost over six weeks in four interest-free payments.

How does Laybuy iPad UK work?

With Laybuy iPad UK, users can choose their iPad and add it to their cart. At checkout, they can select Laybuy as their payment method and create an account or log in to their existing account. Once the order is complete, Laybuy will automatically deduct the first of four payments. The remaining payments will be automatically deducted every two weeks without any additional fees or interest.

Who is eligible for Laybuy iPad UK?

To be eligible for Laybuy iPad UK, users must be 18 years or older and a permanent UK resident, excluding the Channel Islands. They must also meet Laybuy's eligibility criteria and be able to make repayments on time.

What are the late fees for Laybuy iPad UK?

Late fees for Laybuy iPad UK are up to £6 for orders under £24 and the lower of £36 or 25% of the order value for orders over £24. If a payment is still unpaid seven days later, a further £6 fee may be charged. Missed payments may affect users' ability to use Laybuy in the future and may result in their details being passed onto a debt collection agency.

Is Laybuy iPad UK regulated?

Laybuy is not currently regulated by the Financial Conduct Authority (FCA). However, they have their own set of terms and conditions and follow responsible lending practices. It is important for users to use Laybuy responsibly and ensure they can make repayments on time. [27][28]

Openpay iPad UK

Q: What is Openpay iPad UK?

A: Openpay is a payment provider that offers a buy now, pay later option for iPads in the UK. This means that customers can purchase an iPad and pay for it in instalments over a set period of time.

Q: How does Openpay work?

A: Customers can choose the iPad they would like to purchase and select Openpay as their payment option at checkout. They will then be asked to provide some personal and financial details, which will be used to set up a payment plan. The customer will receive their iPad once the first instalment has been paid and will continue to make payments until the total cost of the iPad has been covered.

Q: What are the benefits of using Openpay?

A: Openpay allows customers to spread the cost of their iPad over several months, making it more affordable and manageable. There are no interest or fees charged on the payment plan, and customers can repay their installments ahead of schedule without penalty.

Q: Is Openpay available for all iPads?

A: Openpay is available for a wide range of iPads on the Apple UK website, including the iPad Air, iPad Pro, and iPad Mini. Some models may not be eligible for Openpay, depending on the price and availability.

Q: Is it easy to apply for Openpay?

A: Yes, applying for Openpay is quick and straightforward. Customers can complete the application process online at checkout and receive an instant decision on their eligibility. The application requires some personal and financial information, such as name, address, and income, but it is kept secure and confidential.